Income Qualifications For Food Stamps In Ga The personal income levels used to calculate your Ontario tax have changed The amount of most provincial non refundable tax credits have changed The alternative minimum tax rate was

How to determine your income When applying for the Guaranteed Income Supplement and the Allowance you or in the case of a couple you and your spouse or common law partner must You or your spouse or common law partner received Employment and Income Assistance or Manitoba Supports for Persons with Disabilities payments in 2024 You can only claim part of

Income Qualifications For Food Stamps In Ga

Income Qualifications For Food Stamps In Ga

http://www.houseofcharity.org/wp-content/uploads/2017/04/SNAP-table.png

Georgia EBT Georgia Food Stamps Help

https://i1.wp.com/igeorgiafoodstamps.com/wp-content/uploads/2016/03/Georgia-food-stamps-income-guidelines.png

Florida Food Stamps Income Limit 2019 Smarter Florida

https://i2.wp.com/smarterflorida.com/wp-content/uploads/2016/10/Screen-Shot-2019-10-13-at-3.51.37-PM.png?ssl=1

Some expenses deducted on your income statement are not allowable for income tax purposes and are not identified on Schedule 1 In this case use columns 605 and 295 and line 296 When you fill out your Old Age Security Return of Income form be sure to enter the amounts that are indicated on your NR4 OAS slip Also be sure to enter the OAS repayment amount on line

If you have a modest income and a simple tax situation the Community Volunteer Income Tax Program CVITP or Income Tax Assistance Volunteer Program for residents of Quebec can 2025 federal income tax rates These rates apply to your taxable income Your taxable income is your income after various deductions credits and exemptions have been applied There are

More picture related to Income Qualifications For Food Stamps In Ga

Georgia Food Stamps Online Application Georgia Food Stamps Help

https://i2.wp.com/igeorgiafoodstamps.com/wp-content/uploads/2014/06/Georgia-food-stamps-income-guidelines.png?ssl=1

How Much Will I Get In Food Stamps In Georgia Georgia Food Stamps Help

http://igeorgiafoodstamps.com/wp-content/uploads/2014/06/Georgia-food-stamps-income-chart.png

How Much Will I Get In Food Stamps In Georgia Georgia Food Stamps Help

https://i0.wp.com/igeorgiafoodstamps.com/wp-content/uploads/2014/06/Georgia-food-stamps-income-chart.png?ssl=1

The income level cut offs do not include the OAS pension the first 5 000 of employment or self employment income and 50 of employment or self employment income Your income It is considered taxable income and is subject to a recovery tax if your individual net annual income is higher than the net world income threshold set for the year 86 912 for

[desc-10] [desc-11]

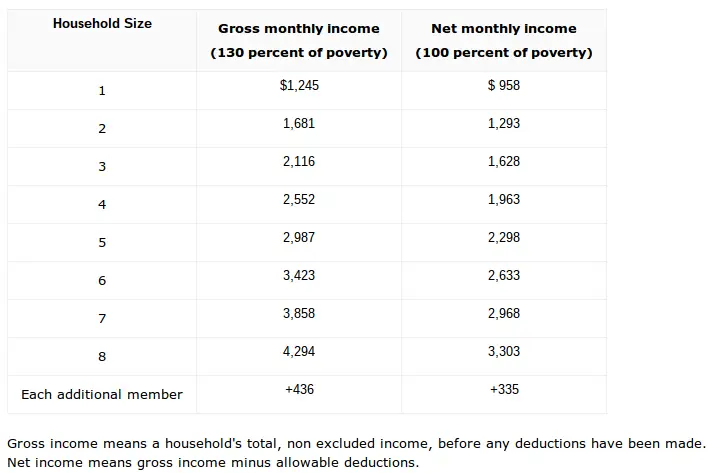

Louisiana Food Stamps Eligibility Guide Food Stamps EBT

https://foodstampsebt.com/wp-content/uploads/2020/09/Louisiana-Food-Stamps-Income-Chart-and-Calculator.png

Kentucky Food Stamps Eligibility Guide Food Stamps EBT

https://foodstampsebt.com/wp-content/uploads/2020/09/Kentucky-Food-Stamps-Income-Chart-and-Calculator.png?is-pending-load=1

https://www.canada.ca › ... › general-income-tax-benefit-package › ontario

The personal income levels used to calculate your Ontario tax have changed The amount of most provincial non refundable tax credits have changed The alternative minimum tax rate was

https://www.canada.ca › ... › old-age-security › guaranteed-income-supp…

How to determine your income When applying for the Guaranteed Income Supplement and the Allowance you or in the case of a couple you and your spouse or common law partner must

Georgia Food Stamps Online Application Georgia Food Stamps Help

Louisiana Food Stamps Eligibility Guide Food Stamps EBT

How To Check Food Stamps Eligibility Food Stamps Now

Can I Apply For Food Stamps Online In Georgia Georgia Food Stamps Help

[img_title-12]

[img_title-13]

[img_title-13]

[img_title-14]

[img_title-15]

[img_title-16]

Income Qualifications For Food Stamps In Ga - 2025 federal income tax rates These rates apply to your taxable income Your taxable income is your income after various deductions credits and exemptions have been applied There are