Deferred Compensation Plan Vs 403b The typical times that deferred settlement is used is a When a company undergoes a reconstruction i e XYZ XYZDA XYZ b When a partly paid security turns

I m looking at SPN and their dividends are 5 776c 0 872C FRANKED 30 3 288C TAX DEFERRED according to ASX au What implication does the tax deferred If I have pre orders and you ve accepted cash for them that is deferred revenue of 5mil and I ve already used 4mil before delivering those orders I only have 1m cash left

Deferred Compensation Plan Vs 403b

Deferred Compensation Plan Vs 403b

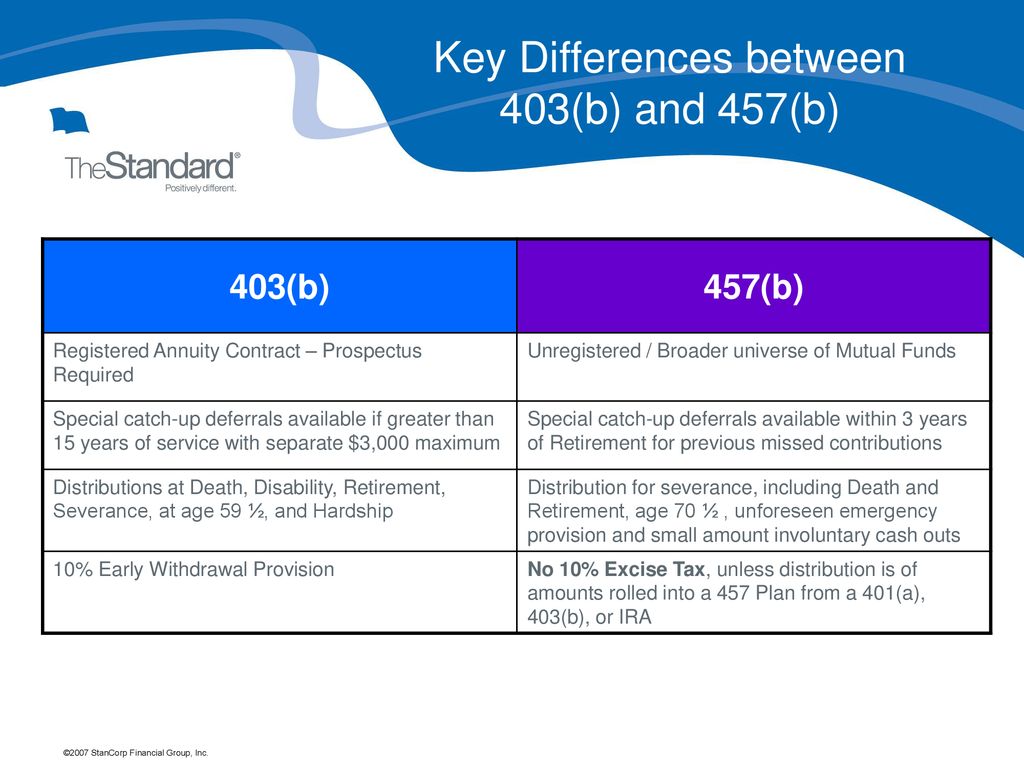

https://slideplayer.com/slide/14157105/86/images/7/Key+Differences+between.jpg

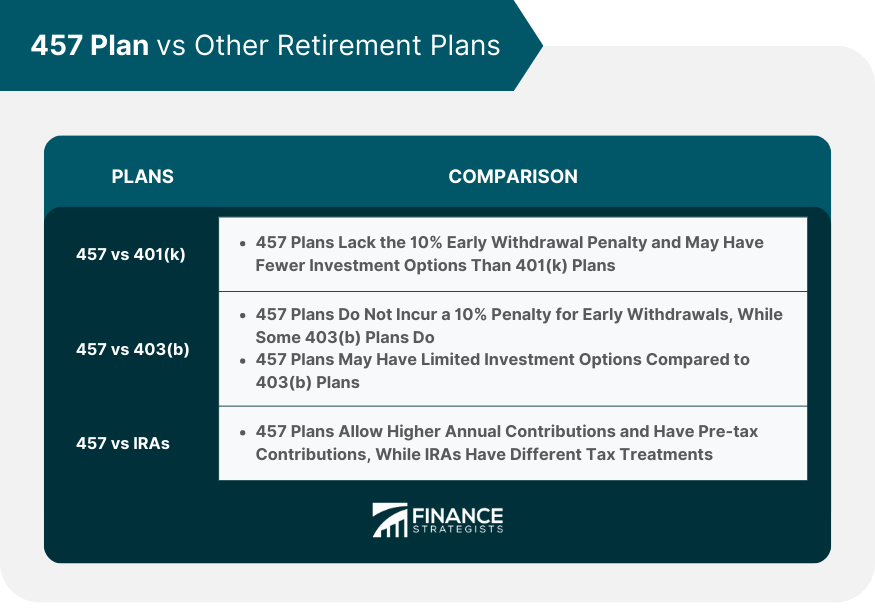

457 b Plan Definition How It Works Pros And Cons 44 OFF

https://www.financestrategists.com/uploads/457-Plan-vs-Other-Retirement-Plans.png

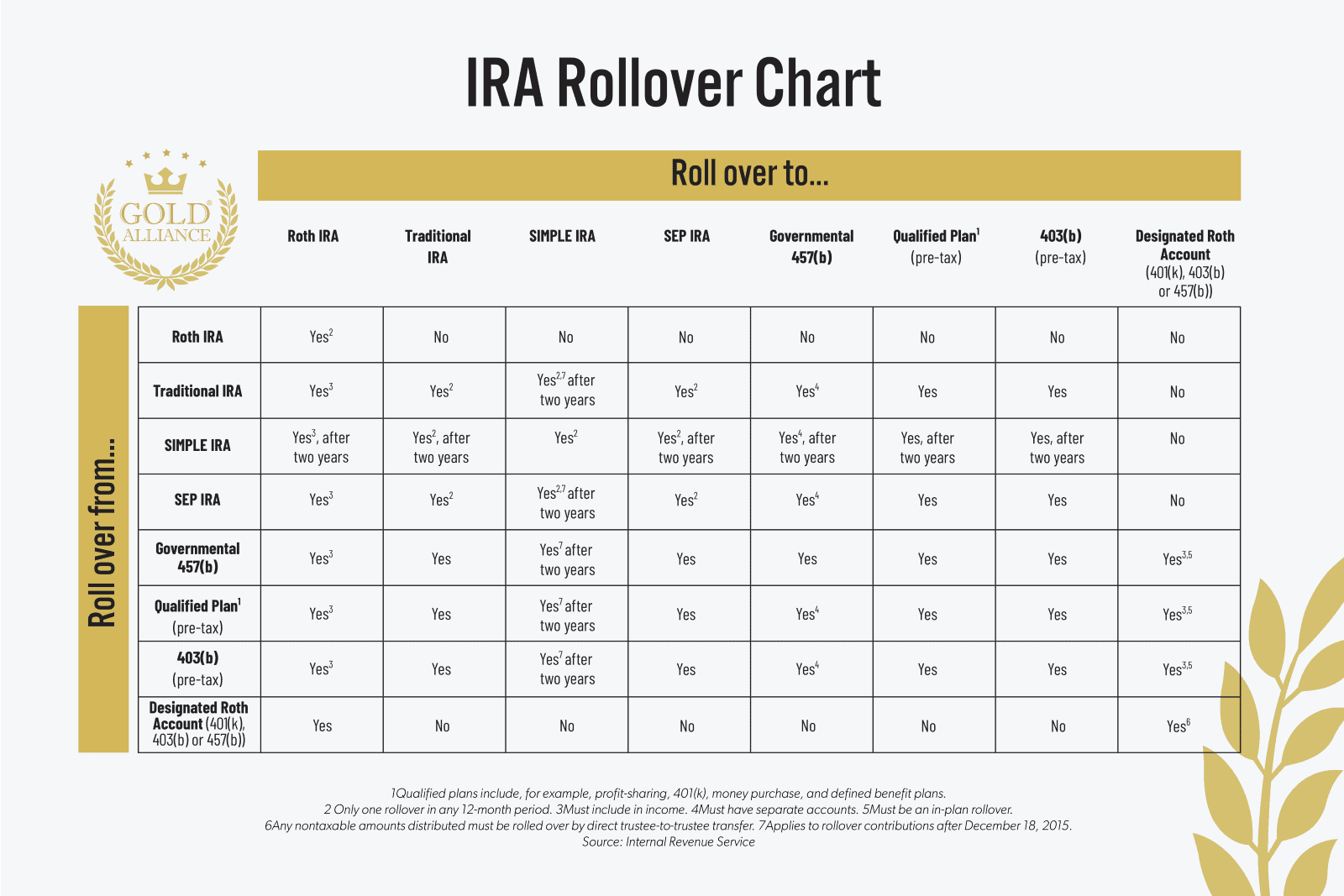

Ira Rollover Rules Choosing Your Gold IRA

https://goldalliance.com/wp-content/uploads/2022/03/image.png

Deferred management Fees Another great business opportunity made by and for Macquarie Bank and a host of other financial leeches The short story Ghoti is that the BIG O As such any investor that is considering selling their units during the deferred settlement period and who may be concerned about the deferred settlement is encouraged to

After 12 months you sell for 7500 The 100 tax deferred amount comes off your purchase price when calculating the capital gain so your gain is 7500 5000 100 2600 1 Each entrant may choose one ASX listed stock or ETF Options warrants and deferred settlement shares are not permitted 2 Stocks with a price of less than 0 01 are

More picture related to Deferred Compensation Plan Vs 403b

Compensation And Benefits Tutorial Deferred Compensation Plan

https://www.vskills.in/certification/tutorial/wp-content/uploads/2021/01/Customer-Feedback-4-1.png

457 Deferred Compensation Plan Choosing Your Gold IRA

https://static.twentyoverten.com/58ae1c41dd96335b30ab0d96/GEkTMfMaJc/2-Types-of-457b-Plans-or-WealthKeel.png

Comparison Of 401 k And 457 Plans National Benefit Services

http://www.nbsbenefits.com/wp-content/uploads/2016/02/457-Comparison-Chart-1.png

Good morning everyone and welcome to the November 2023 stock tipping competition entry thread A quick recap of the rules for those not familiar with them 1 Each If the shares were transfered to a company in which you re GF and or yourself is a director then there is also the possibility of a Deferred Tax Asset DTA or a Deferred Tax

[desc-10] [desc-11]

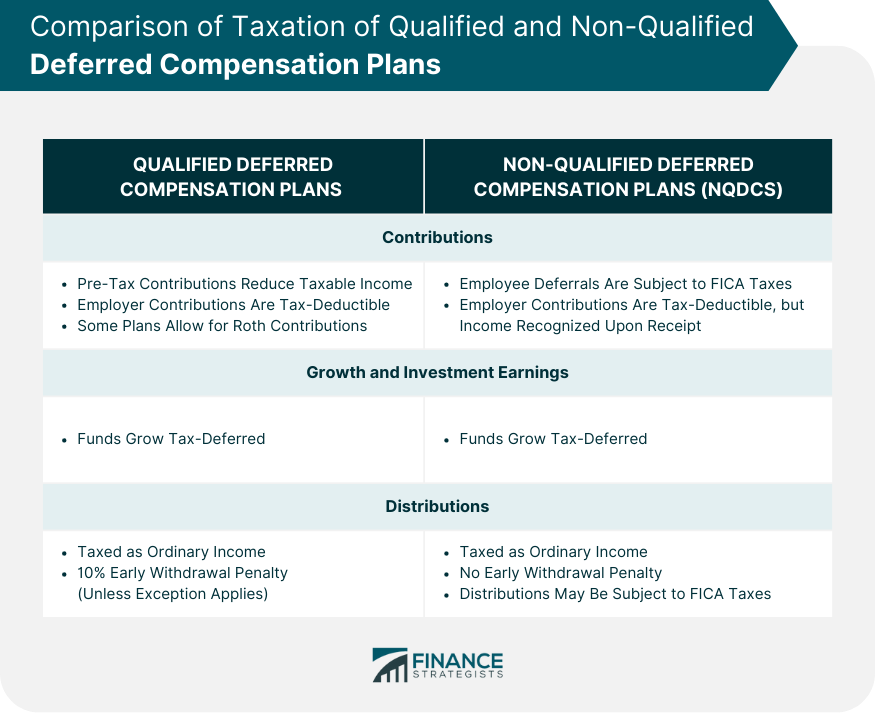

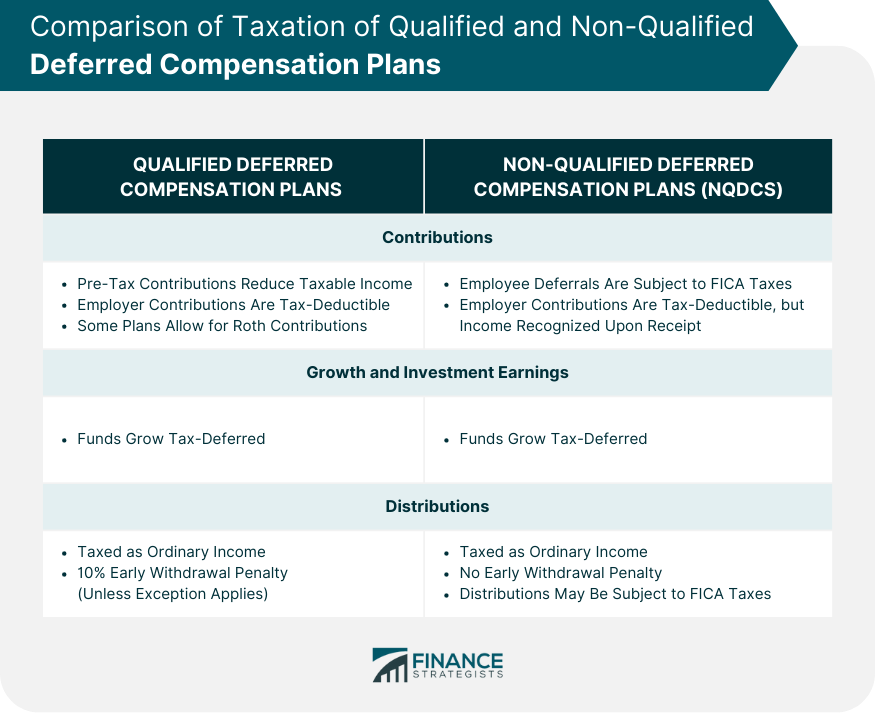

Deferred Compensation Limits 2024 Andy Maegan

https://www.financestrategists.com/uploads/Comparison_of_Taxation_of_Qualified_and_Non-Qualified_Deferred_Compensation_Plans.png

Max 403b 2025 Kyla Lawson

https://i.ytimg.com/vi/jbOOSRfvvcI/maxresdefault.jpg

https://www.aussiestockforums.com › threads

The typical times that deferred settlement is used is a When a company undergoes a reconstruction i e XYZ XYZDA XYZ b When a partly paid security turns

https://www.aussiestockforums.com › threads

I m looking at SPN and their dividends are 5 776c 0 872C FRANKED 30 3 288C TAX DEFERRED according to ASX au What implication does the tax deferred

2024 403b Limit Jane Roanna

Deferred Compensation Limits 2024 Andy Maegan

_vs._457(b).png?width=4800&height=2700&name=403(b)_vs._457(b).png)

Maximum Allowable 457 Contribution 2025 Olympics Peter S Perez

Max Contribution To 457 2024 Katee Matilde

Maladie De Parkinson R adaptation Neuro Cartes Quizlet

Ira Contribution Limits 2024 With 401k Erna Odette

Ira Contribution Limits 2024 With 401k Erna Odette

2025 Hsa Maximum Contribution Felix N Bak

401k 2024 Maximum Contribution Age Tedi Abagael

Maximum Deferred Compensation Contribution 2025 Bili Mariya

Deferred Compensation Plan Vs 403b - Deferred management Fees Another great business opportunity made by and for Macquarie Bank and a host of other financial leeches The short story Ghoti is that the BIG