401k Vs 403 B Withdrawal Employer contributions A key advantage of 401 k s is that your employer may also contribute to help you save for retirement This typically comes in the form of a 401 k

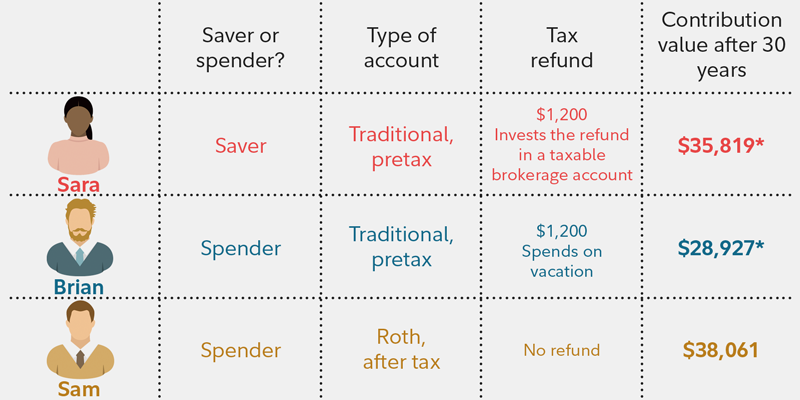

Roth 401 k s When 401 k plans were first rolled out in the 1980s companies and their employees had one choice the traditional 401 k Roth 401 k s didn t arrive until 2006 A 401 k is an employer sponsored retirement plan that comes with tax benefits Basically you put money into the 401 k where it can be invested and potentially grow tax free

401k Vs 403 B Withdrawal

_vs._457(b).png?width=960&height=540&name=403(b)_vs._457(b).png)

401k Vs 403 B Withdrawal

https://www.carboncollective.co/hs-fs/hubfs/403(b)_vs._457(b).png?width=960&height=540&name=403(b)_vs._457(b).png

Blackjack Rules Simple Ira Todellisia Rahaa Online kasino Pelej

http://2.bp.blogspot.com/-PnnMVGwKZW8/T3JOY20apII/AAAAAAAABMY/Wwr8lusO0TI/s1600/rollover.jpg

.png)

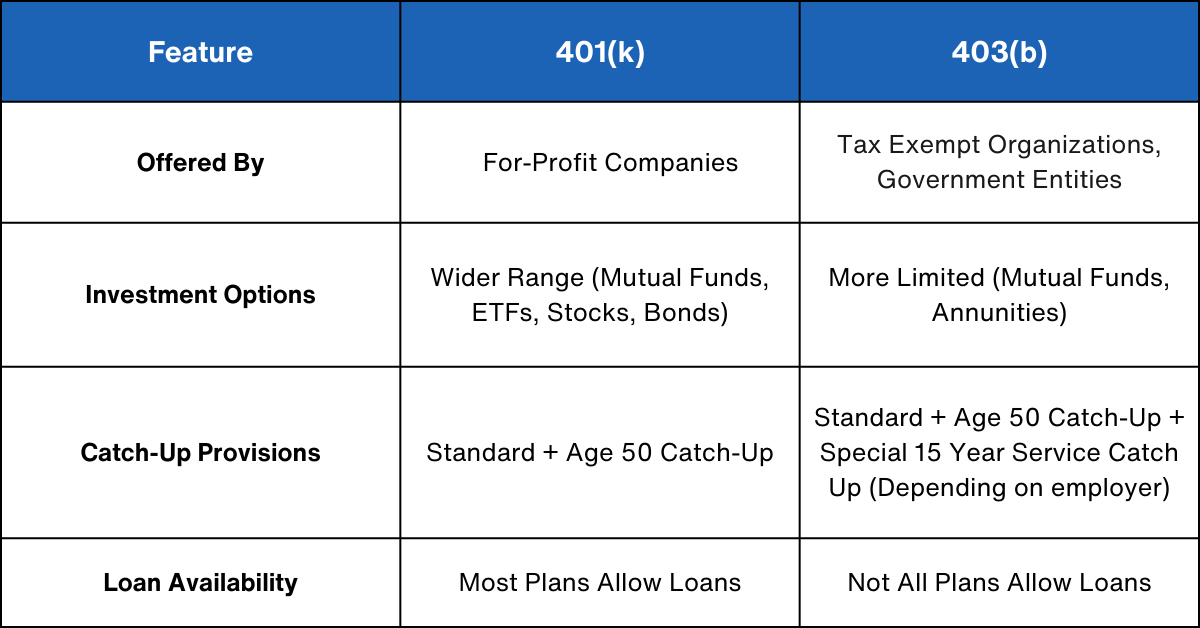

Retirement Savings 403 b Vs 401 k Explained Fortress Financial Group

https://images.squarespace-cdn.com/content/v1/6352f579a98b033ca4a4810e/0ea4eee5-4370-4a73-a108-a6dc3a8432ad/Feature0+(1).png

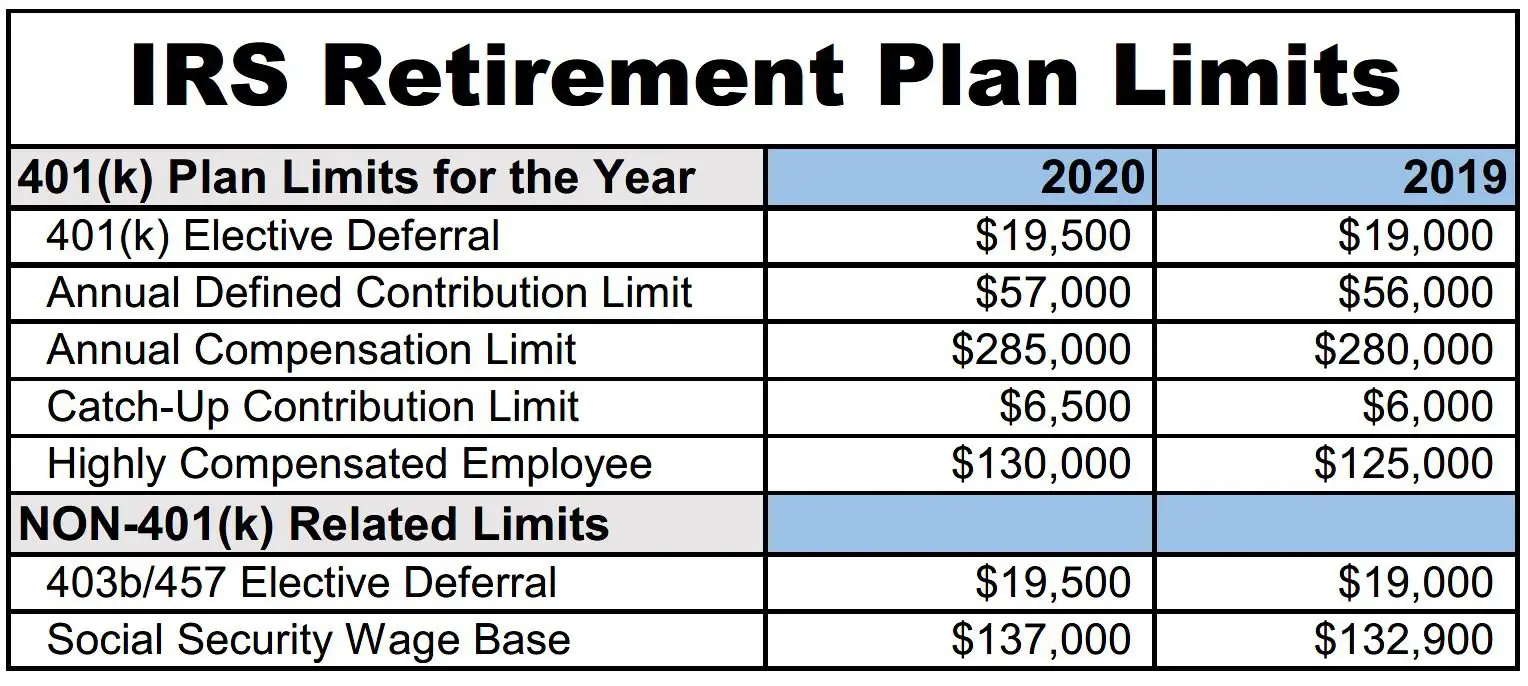

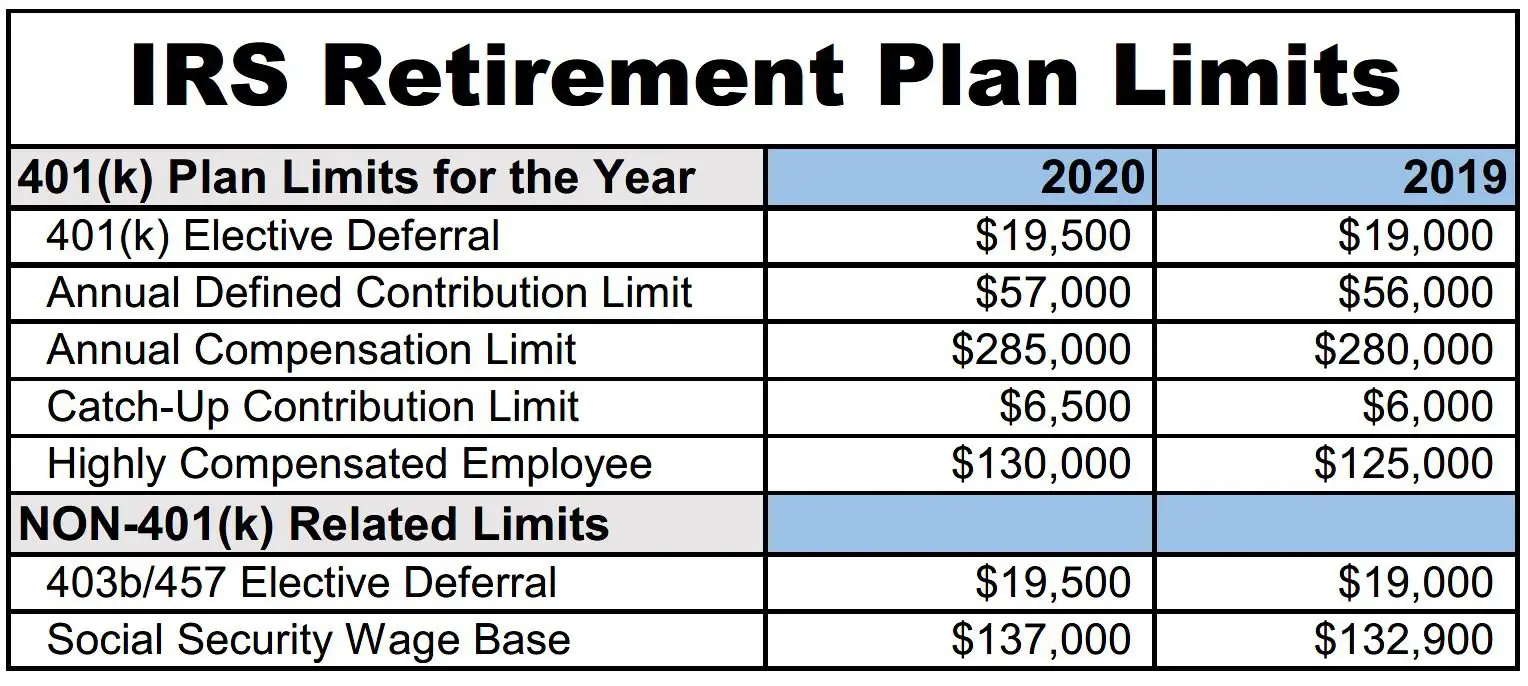

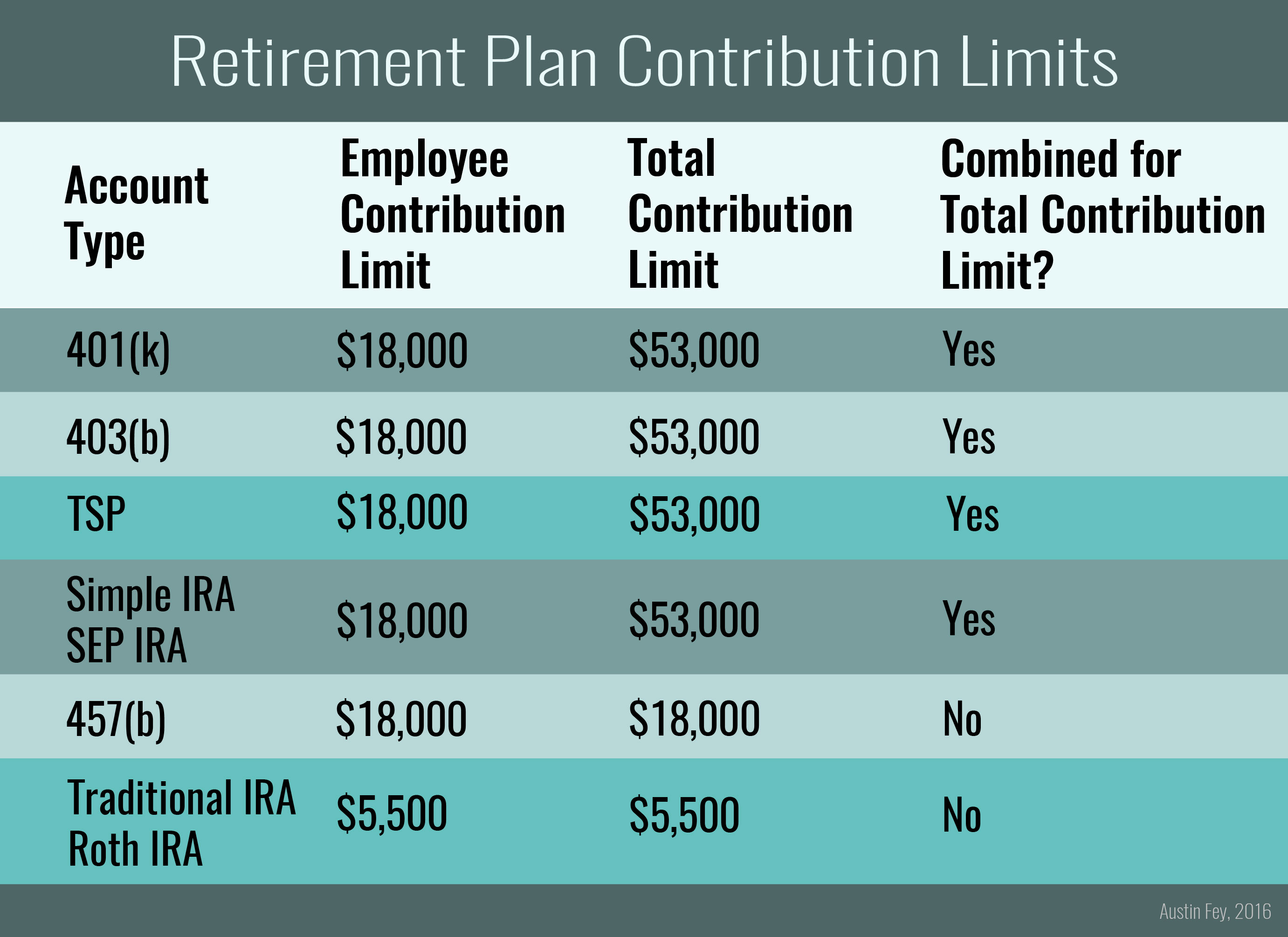

A 401 k is a staple for many people s retirement planning so it s important to understand how they work Browse Investopedia s expert written library to learn more Contribution Type Contribution Limit 2025 Employee contributions 23 500 Catch up contribution employees 50 or older 7 500 SIMPLE 401 k contributions

A Roth 401k plan is much the same as a traditional 401 k except employee contributions are made with after tax dollars Roth contributions don t reduce your taxable Should I Move 401k to Bonds Should You Keep Investing in Your 401 k Plan Should You Put Your 401 k Into an Annuity Understanding and Maximizing Your Roth 401 k

More picture related to 401k Vs 403 B Withdrawal

2025 Max 401k Contribution Limits Employer Natalie Sequeira

https://thecollegeinvestor.com/wp-content/uploads/2023/11/CollegeInvestor_1200x628_Infographic_2024_403b_Contribution_Limits.png

Max 401k Contribution 2025 Including Employers Jesus R Davis

https://www.annuity.org/wp-content/uploads/401k-employer-matching-768x609.jpg

_Withdrawal_Rules.png?width=5760&name=403(b)_Withdrawal_Rules.png)

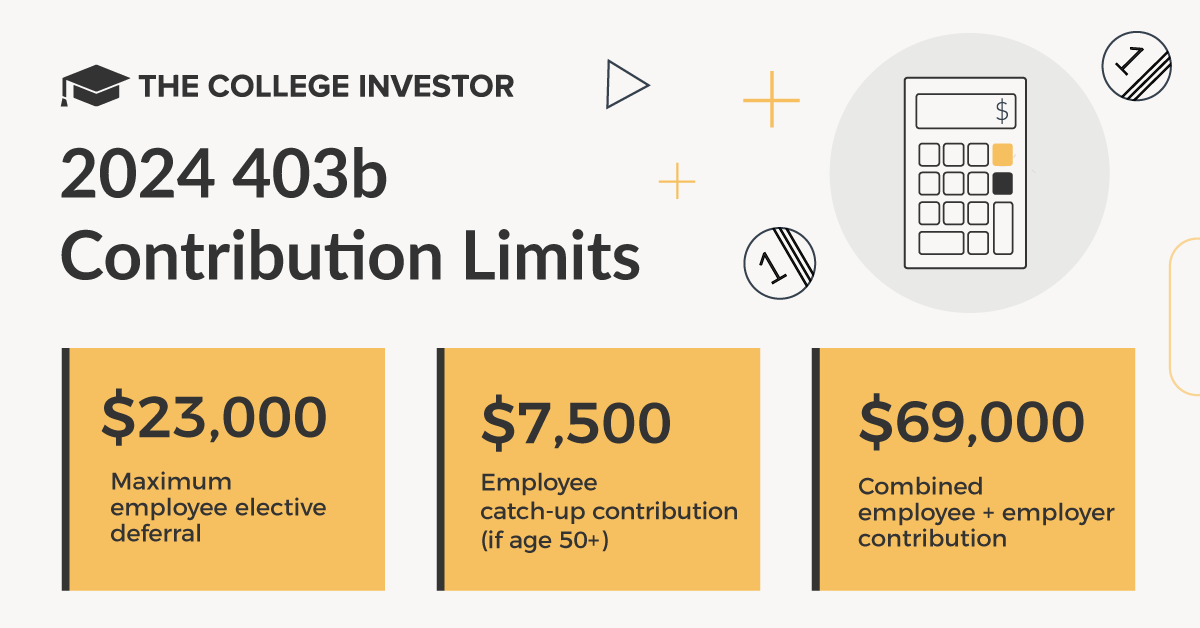

403b Maximum Contribution 2025 Benny Cecelia

https://www.carboncollective.co/hs-fs/hubfs/403(b)_Withdrawal_Rules.png?width=5760&name=403(b)_Withdrawal_Rules.png

1 U S Bureau of Labor Statistics 73 percent of civilian workers had access to retirement benefits in 2023 September 2023 2 IRS 401 k Plan Qualification A 401 k plan is an investment account offered by your employer that allows you to save for retirement If your company offers a 401 k plan it may have certain eligibility requirements

[desc-10] [desc-11]

401k 2024 Maximum Contribution Age Tedi Abagael

https://cdn.statically.io/img/www.401kinfoclub.com/f=auto/wp-content/uploads/retirement-plan-contribution-limits-will-increase-in-2020-ward-and.jpeg

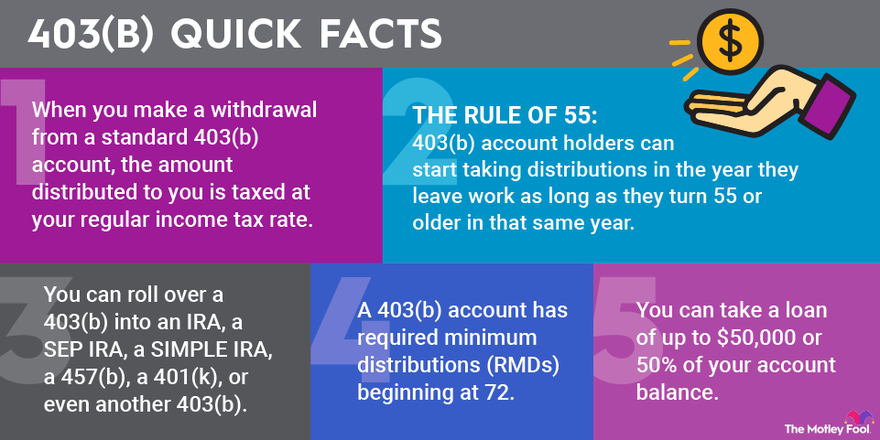

First Time Home Buyer 401k Withdrawal 2024 Jacky Liliane

https://m.foolcdn.com/media/dubs/images/403b-withdrawal-infographic.width-880.png

_vs._457(b).png?width=960&height=540&name=403(b)_vs._457(b).png?w=186)

https://www.fidelity.com › learning-center › smart-money

Employer contributions A key advantage of 401 k s is that your employer may also contribute to help you save for retirement This typically comes in the form of a 401 k

https://www.investopedia.com › terms

Roth 401 k s When 401 k plans were first rolled out in the 1980s companies and their employees had one choice the traditional 401 k Roth 401 k s didn t arrive until 2006

Roth IRA Or Traditional IRA Or 401 k Fidelity

401k 2024 Maximum Contribution Age Tedi Abagael

Traditional Ira Vs Roth Ira Choosing Your Gold IRA

Rollover Ira To 401k Best Gold IRA Accounts

401k Contribution Limits 2025 Employer And Employee Jim A Decker

_vs._457(b).png?width=4800&height=2700&name=403(b)_vs._457(b).png)

What Is The Maximum 457b Contribution 2024 Page Tricia

_vs._457(b).png?width=4800&height=2700&name=403(b)_vs._457(b).png)

What Is The Maximum 457b Contribution 2024 Page Tricia

A Comprehensive Guide To A 403b Vs 401k 2024

A Comprehensive Guide To A 403b Vs 401k 2024

401k 2024 Contribution Limit Chart Employer Match Dari Madlin

401k Vs 403 B Withdrawal - [desc-13]