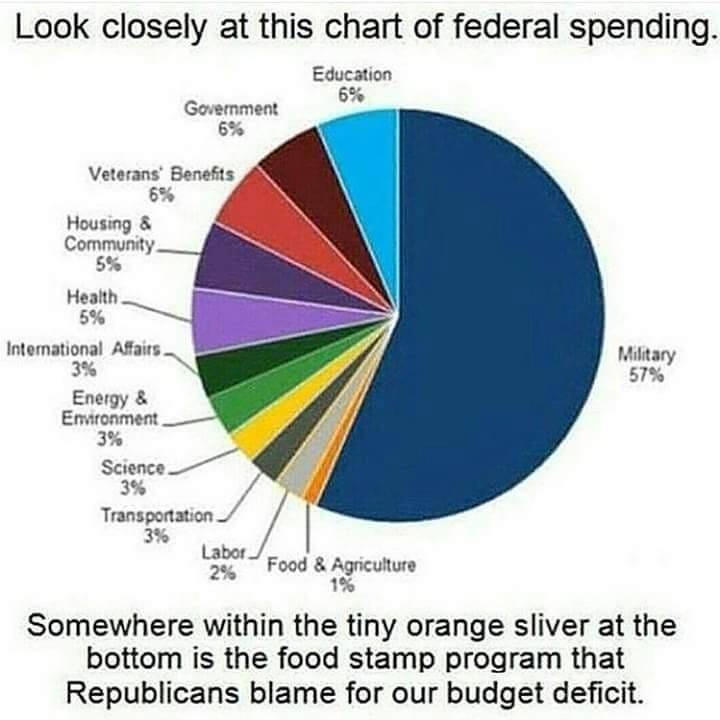

Pie Chart Taxes Mad About Food Stamps Corporate Subsidies Federal subsidies to corporate America take many forms direct grant payments below market insurance direct loans and loan guarantees trade protection contracts for unneeded activities and unjustified special interest loopholes in the tax code

Citizens for Tax Justice found that the U S Treasury lost 181 billion in corporate tax subsidies which means the average American family could be out as much as 1 600 per year About 59 billion is spent on traditional social welfare programs 92 billion is spent on corporate subsidies So the government spent 50 more on corporate welfare than it did on food stamps and housing assistance in 2006

Pie Chart Taxes Mad About Food Stamps Corporate Subsidies

Pie Chart Taxes Mad About Food Stamps Corporate Subsidies

https://dn.truthorfiction.com/wp-content/uploads/2020/02/17123209/50000_a_year_36_food_stamps_4000_corporate_subsidies-1024x536.png

Corporate Subsidies Antiwork

https://preview.redd.it/9kj4cd5kt5p81.jpg?width=960&crop=smart&auto=webp&s=c785af7d6fc819ed8802f4f05cef8b29bbb15ede

Food Stamps Housing Subsidies And Other Services For America s Poor At Risk As Shutdown Drags

https://thepcc.org/sites/default/files/field/image/QQMPGMQTZMI6TK3ZGDGU66JG6I.jpg

The Governor s Executive budget includes updated estimates for spending on corporate welfare which is government favoritism of one sector or business over others This favoritism is disquised under less innocuous terms such as economic development subsidies 870 for Corporate Tax Subsidies We ve heard a lot about tax avoidance and tax breaks for the super rich With regard to corporations alone the Tax Foundation has concluded that their special tax provisions cost taxpayers over 100 billion per year or 870 per family Corporate benefits include items such as Graduated Corporate Income

Summary Pictured are two pie charts These pie charts show the relative sizes of the major categories of federal income and outlays for fiscal year 2023 Social security Medicare and other retirement see Footnote 1 39 Footnote 1 These programs provide income support for the retired and disabled and medical care for the elderly The Supplemental Nutritional Assistance Program SNAP also known as the food stamp program is back in the news amid recent changes enacted as part of a debt ceiling deal between President Joe Biden and House Republicans

More picture related to Pie Chart Taxes Mad About Food Stamps Corporate Subsidies

This Pie Chart Lies About Food Stamps Chris Powell Medium

https://cdn-images-1.medium.com/max/1200/1*q4yDYp8ksKUhOQTmWlqz-A.jpeg

Politics Subsidies Memes GIFs Imgflip

https://i.imgflip.com/5j93i5.jpg

How Republicans Who Took Millions In Farm Subsidies Justify Cutting Food Stamps ThinkProgress

https://archive.thinkprogress.org/uploads/2013/06/0HeP9q-0EDDTE84ij.png?w=590&h=1080&crop=1

Recent increases in corporate welfare for farm subsidies broadband the electric grid electric vehicles and renewable energy have pushed subsidies even higher Harms consumers and businesses Using the pie charts below match the budget information with its correct percentage of revenue by choosing the correct revenue percentage from the drop down menu To assess your answers click the Check My Answers button at the bottom of the page

We begin by looking at the issue of measuring corporate welfare and then discuss the various costs and consequences associated with the federal government favoring particular commercial interests These charts reflect our state by state calculations of how much lawmakers could reduce their states corporate income personal income sales and total tax burdens if they eliminated corporate incentives

Republicans Are Making A Deal On Food Stamps And Farm Subsidies HuffPost

https://img.huffingtonpost.com/asset/5bef08a03c00001b040eba3d.jpeg?cache=nusthpaloy&ops=1910_1000

The United States Of Subsidies The Biggest Corporate Winners In Each State Good Jobs First

https://img.washingtonpost.com/wp-apps/imrs.php?src=https://img.washingtonpost.com/blogs/govbeat/files/2015/03/Pasted_Image_3_17_15__8_42_AM.png&w=1484

https://www.hoover.org › research › welfare-well-how...

Federal subsidies to corporate America take many forms direct grant payments below market insurance direct loans and loan guarantees trade protection contracts for unneeded activities and unjustified special interest loopholes in the tax code

https://truthout.org › articles › food-stamps-are...

Citizens for Tax Justice found that the U S Treasury lost 181 billion in corporate tax subsidies which means the average American family could be out as much as 1 600 per year

Federal Subsidies To The States Remain High Mercatus Center

Republicans Are Making A Deal On Food Stamps And Farm Subsidies HuffPost

2024 Food Stamps Income Limit Dacy Michel

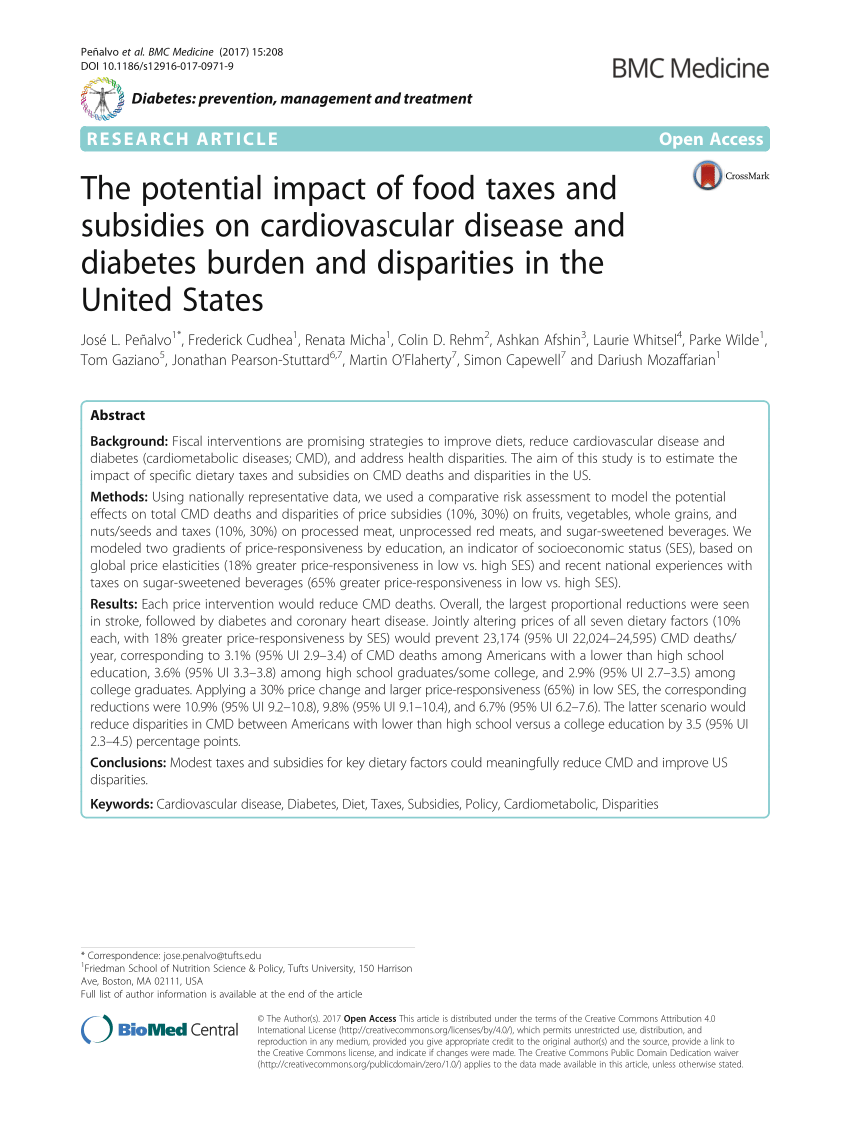

PDF The Potential Impact Of Food Taxes And Subsidies On Cardiovascular Disease And Diabetes

Corporate Welfare And Your Tax Bill The Meme Policeman

Why Was I Denied Food Stamps 7 Common Reasons And How To Appeal Esquilo io

Why Was I Denied Food Stamps 7 Common Reasons And How To Appeal Esquilo io

Corporate Subsidies Versus Public Education How Tax Abatements Cost New York Public Schools

Farm Bill Prolonging The Food Stamp Tragedy And Farm Subsidies FreedomWorks

Do You Have To Pay Tax On Food Stamps The Rules Explained The US Sun

Pie Chart Taxes Mad About Food Stamps Corporate Subsidies - 870 for Corporate Tax Subsidies We ve heard a lot about tax avoidance and tax breaks for the super rich With regard to corporations alone the Tax Foundation has concluded that their special tax provisions cost taxpayers over 100 billion per year or 870 per family Corporate benefits include items such as Graduated Corporate Income