Is Fast Food Taxed In Indiana Indiana applies a 7 sales tax on most food items but certain groceries such as fresh produce and unprepared foods are exempt However complexities arise when

Yes food is generally subject to sales tax in Indiana While most states exempt certain types of food items from sales tax Indiana has a different approach The default tax rate for most food FAB applies to transactions in counties municipalities that have enacted this tax type in which food or beverages are furnished prepared or served by a retail merchant for consumption at a

Is Fast Food Taxed In Indiana

Is Fast Food Taxed In Indiana

https://i.ytimg.com/vi/Tx264juR4Yo/maxresdefault.jpg

Is Food Taxed In Arkansas YouTube

https://i.ytimg.com/vi/0cNStmNqxH0/maxresdefault.jpg

Military Pensions No Longer Taxed In Indiana YouTube

https://i.ytimg.com/vi/QdYBcxSZ9ZM/maxresdefault.jpg

When you purchase food or beverages in Indiana you ll be charged the applicable sales tax rate The tax is usually added to the price of the item and is reflected on the receipt Generally the sale of food and food ingredients for human consumption is exempt from Indiana sales tax Primarily the exemption is limited to the sale of food and food ingredients commonly

The food and beverage tax rate in Indiana is capped at 1 of the gross retail income from eligible transactions ensuring uniformity and predictability for businesses This Indiana Food for immediate consumption is taxable Here s what Indiana has to say about what constitutes food for immediate consumption Sales of taxable prepared food include the following food sold in a heated

More picture related to Is Fast Food Taxed In Indiana

Is Hot Food Taxed In Florida YouTube

https://i.ytimg.com/vi/aa6JXdiuMGk/maxresdefault.jpg

Bad Luck Brian Meme Imgflip

https://i.imgflip.com/16jsni.jpg

State Tax Rates 2025 Nabil Theodore

https://russellinvestments.com/-/media/images/us/blogs/images/kuharicjuly19_3.jpg

Food and food ingredients are generally exempt from sales tax under Indiana Code Section 6 2 5 5 20 This includes most items you d find at a grocery store in addition to unheated foods and baked goods Indiana has a history of unpredictable if you will rulings on what to tax and what not to tax A 2012 bulletin from the Indiana Department of Revenue on the sales of food and

Is There Tax on Food in Indiana In the state of Indiana food for home consumption is generally exempt from sales tax This means that most groceries including fruits vegetables dairy This page describes the taxability of food and meals in Indiana including catering and grocery food To learn more see a full list of taxable and tax exempt items in Indiana

Food Lesson Plans ESL Brains

https://eslbrains.com/wp-content/uploads/2021/09/Should-junk-food-be-taxed.png

How Much Money You Take Home From A 100 000 Salary After Taxes

https://i.pinimg.com/736x/44/7a/ee/447aee88612d958ba5133c2d68141a31.jpg

https://handsoffsalestax.com › indiana-sales-tax-on-food

Indiana applies a 7 sales tax on most food items but certain groceries such as fresh produce and unprepared foods are exempt However complexities arise when

https://www.chefsresource.com › is-food-taxed-in-indiana

Yes food is generally subject to sales tax in Indiana While most states exempt certain types of food items from sales tax Indiana has a different approach The default tax rate for most food

Revenue Canada 2025 Income Tax Forms Images References Michelle S

Food Lesson Plans ESL Brains

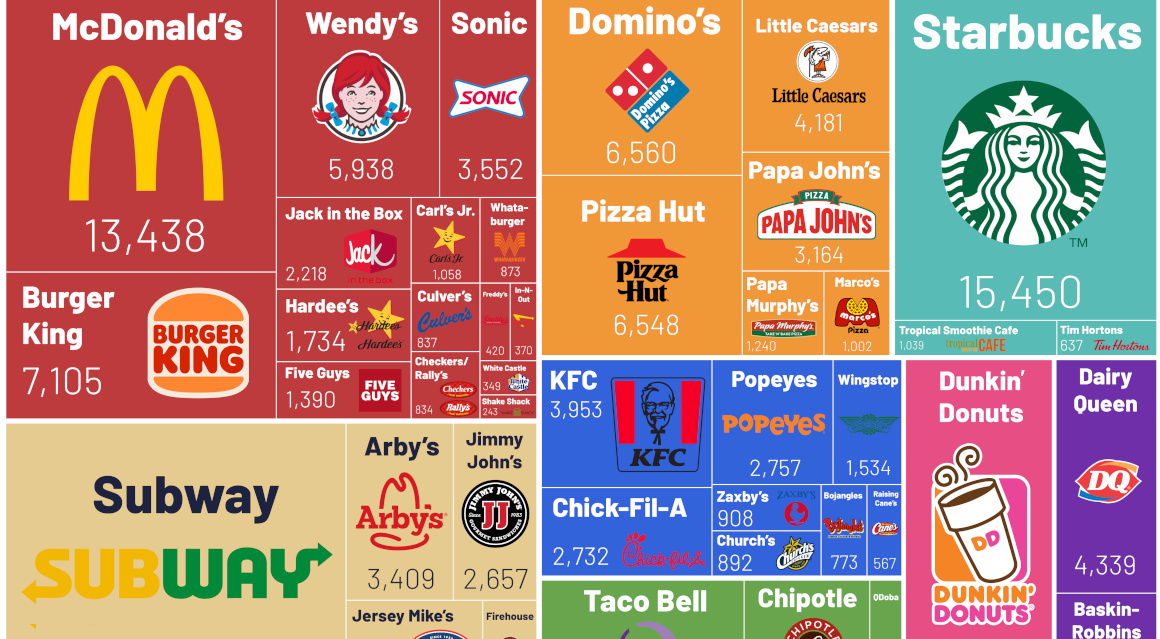

Visualizing America s Most Popular Fast Food Chains

Social Security Retirement Income Limit 2025 Julie M Hibbs

2025 Tax Calculator Canada Online Danny S Conway

Visualizing America s Most Popular Fast Food Chains City Roma News

Visualizing America s Most Popular Fast Food Chains City Roma News

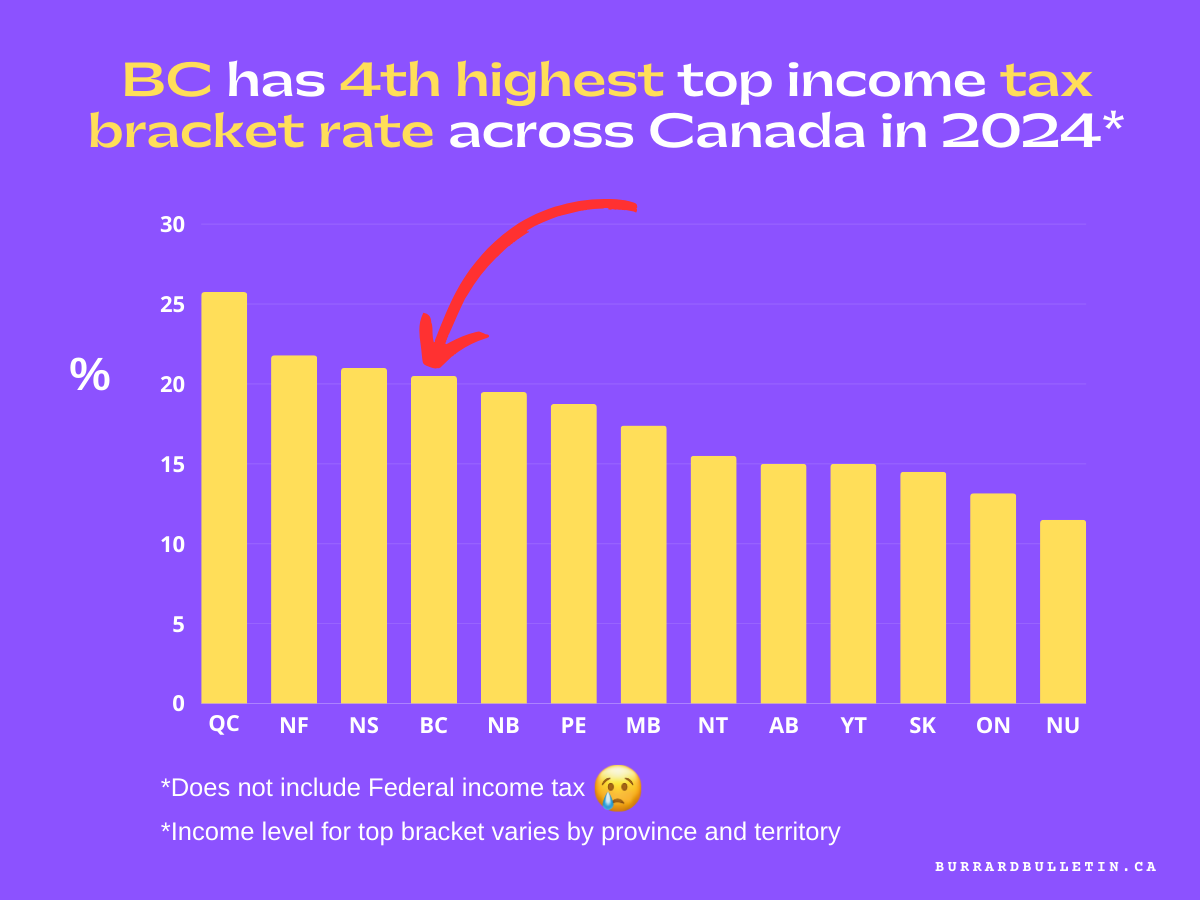

It s Tax Time Canada Here s How Much You Owe In Each Province

Social Security Max 2024 Withholding Glenn Kalinda

How Many Wawa Stores Are There In New Jersey

Is Fast Food Taxed In Indiana - Indiana Food for immediate consumption is taxable Here s what Indiana has to say about what constitutes food for immediate consumption Sales of taxable prepared food include the following food sold in a heated