Income Chart For Food Stamps Tn Gross Income Net Income and Asset Limits for SNAP Food Stamps in Tennessee for Oct 1 2024 through Sept 30 2025

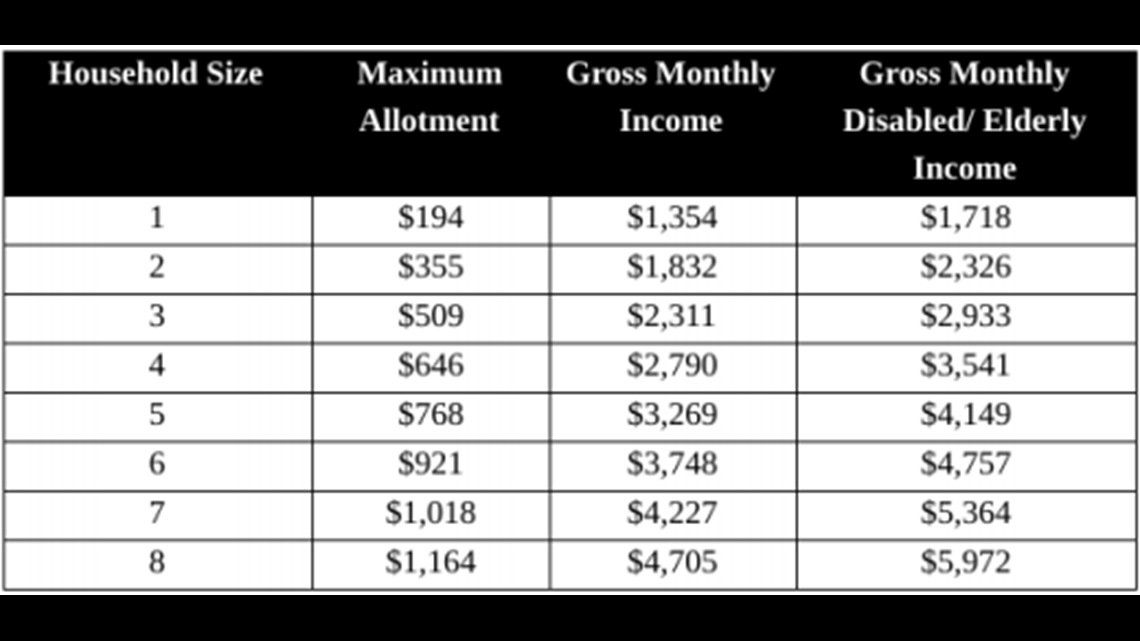

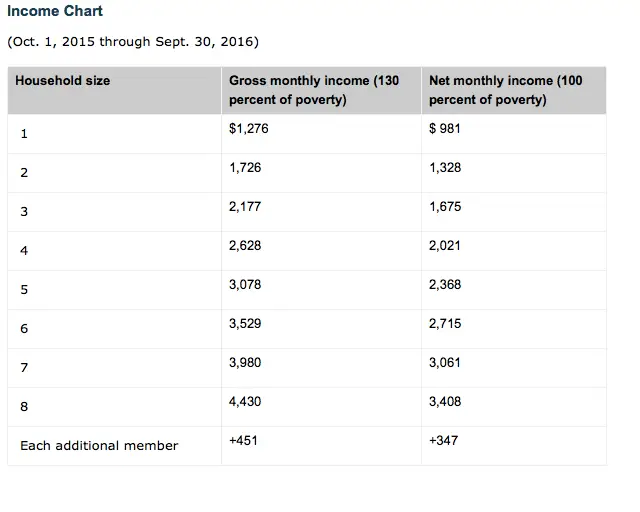

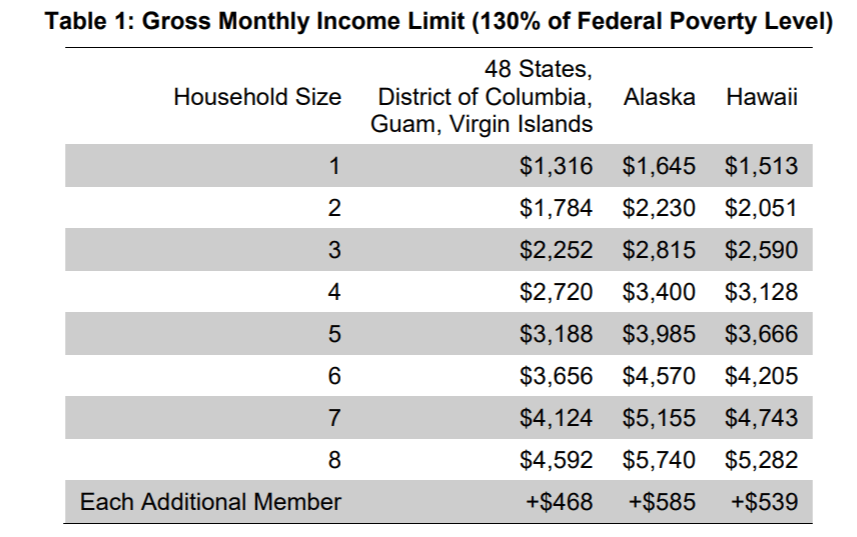

Deductions Certain deductions like the standard deduction and shelter cost deduction which can reduce your countable income are also updated The charts below list the before and after maximum benefits and monthly income limits for SNAP in Tennessee Gross Income Standard 130 Maximum Net Income 100 Gross Income Standard for Elderly or Disabled 165 Maximum allotment amount Number of people in Household Gross Income Standard 130 1 1 396 1 074 1 771 250 13 7 299 2 1 888 1 452 2 396 459 14 7 791 3 2 379 1 830 3 020 658 15 8 283 4 2 871 2 209 3 644 835 16 8 775

Income Chart For Food Stamps Tn

Income Chart For Food Stamps Tn

https://i2.wp.com/www.itennesseefoodstamps.com/wp-content/uploads/2017/05/how-much-will-I-get-in-GA-Food-stamps.png?resize=605%2C610&ssl=1

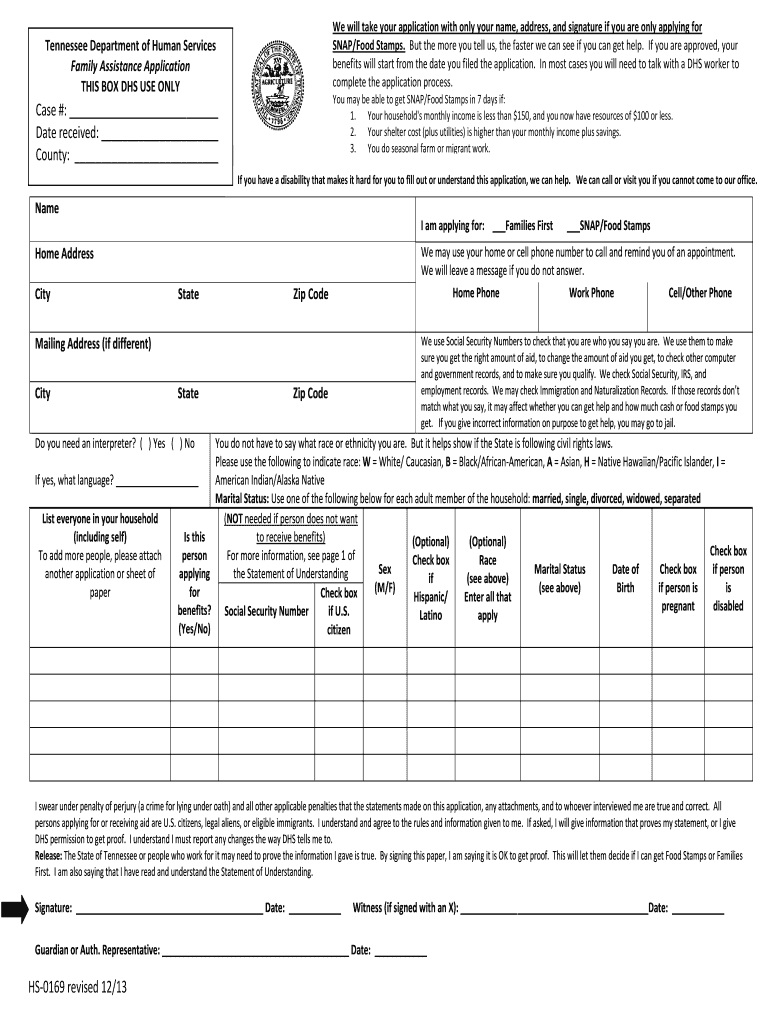

Apply For Food Stamps Online TN Food Stamps Now

https://i2.wp.com/foodstampsnow.com/wp-content/uploads/2016/10/TN-Income-Chart.png?resize=640%2C512&ssl=1

2024 Food Stamps Income Limit Dacy Michel

https://assets-global.website-files.com/5a585cd951b49400018c874a/628ebc104b7c10a85467a94d_25457 - Food stamps blog post charts_FC - Income chart.jpg

Tennessee SNAP EBT food stamps eligibility criteria and guidelines including information on income and asset limits allowable deductions and more Find out if you may be eligible for food stamps and an estimated amount of benefits you could receive in Tennessee

Use the Tennessee Food Stamps Calculator provided below to find out how much you will receive in food assistance benefits To begin we first have to look at the maximum benefit a household could get This amount is set each year by To figure out if you qualify for food stamps Tennessee needs to know your Household size How many people you live and buy make food with Income How much money your household makes This includes both earned income the money you make from jobs and unearned income cash assistance Social Security unemployment insurance and child

More picture related to Income Chart For Food Stamps Tn

Florida Food Stamps Income Limit 2019 Smarter Florida

https://i2.wp.com/smarterflorida.com/wp-content/uploads/2016/10/Screen-Shot-2019-10-13-at-3.51.37-PM.png?ssl=1

Food Stamps Florida Income Limits 2024 Caye Maxine

https://media.wusa9.com/assets/WUSA/images/0ded1c5c-011d-4643-99aa-f2d992806a6c/0ded1c5c-011d-4643-99aa-f2d992806a6c_1140x641.png

Tennessee Food Stamps Calculator 2022 Tennessee Food Stamps

https://i0.wp.com/www.itennesseefoodstamps.com/wp-content/uploads/2022/08/Maximum-SNAP-benefits-by-Household-Size.png?resize=1024%2C524&ssl=1

Below is a table that lists the maximum SNAP allotment for Tennessee View the 2024 Tennessee food stamps income requirements to see if you qualify for SNAP benefits Countable income can include but is not limited to employment self employment and alimony The net income standards apply to households that have an elderly or disabled member They do not need to meet the gross income requirements Income deductions are allowed under the Food Stamp rules

The first thing your caseworker will look at when reviewing your eligibility for food stamps is your gross income according to the U S Department of Agriculture USDA Gross means your whole income before deductions The USDA sets the guidelines for Our SNAP Eligibility Calculator can give you a dollar estimate of what you could receive in SNAP benefits Find out if you may be eligible for SNAP and an estimated amount of benefits you could receive in tennessee

How Food Stamps Verifies Income A Comprehensive Guide

https://i2.wp.com/foodstampsnow.com/wp-content/uploads/2018/12/food-stamps-income-chart.png?resize=710%2C506&ssl=1

Food Stamp Income Chart Mississippi Food Stamps Income Chart Dirim A Household May Be One

http://foodstampsnow.com/wp-content/uploads/2016/10/TN-Income-Chart.png

https://www.snapscreener.com › guides › tennessee

Gross Income Net Income and Asset Limits for SNAP Food Stamps in Tennessee for Oct 1 2024 through Sept 30 2025

https://www.snapscreener.com › blog › annual-snap-update › tennessee

Deductions Certain deductions like the standard deduction and shelter cost deduction which can reduce your countable income are also updated The charts below list the before and after maximum benefits and monthly income limits for SNAP in Tennessee

Find Your Local Food Stamp Office In Fayetteville Tennessee

How Food Stamps Verifies Income A Comprehensive Guide

Income Limits For Snap Tennessee

Snap Income Limits 2024 Tennessee Eran Odella

Tennessee Food Stamp Income Limits For 2024 YouTube

Louisiana Food Stamp Income Limits For 2024 YouTube

Louisiana Food Stamp Income Limits For 2024 YouTube

[img_title-14]

[img_title-15]

[img_title-16]

Income Chart For Food Stamps Tn - To figure out if you qualify for food stamps Tennessee needs to know your Household size How many people you live and buy make food with Income How much money your household makes This includes both earned income the money you make from jobs and unearned income cash assistance Social Security unemployment insurance and child