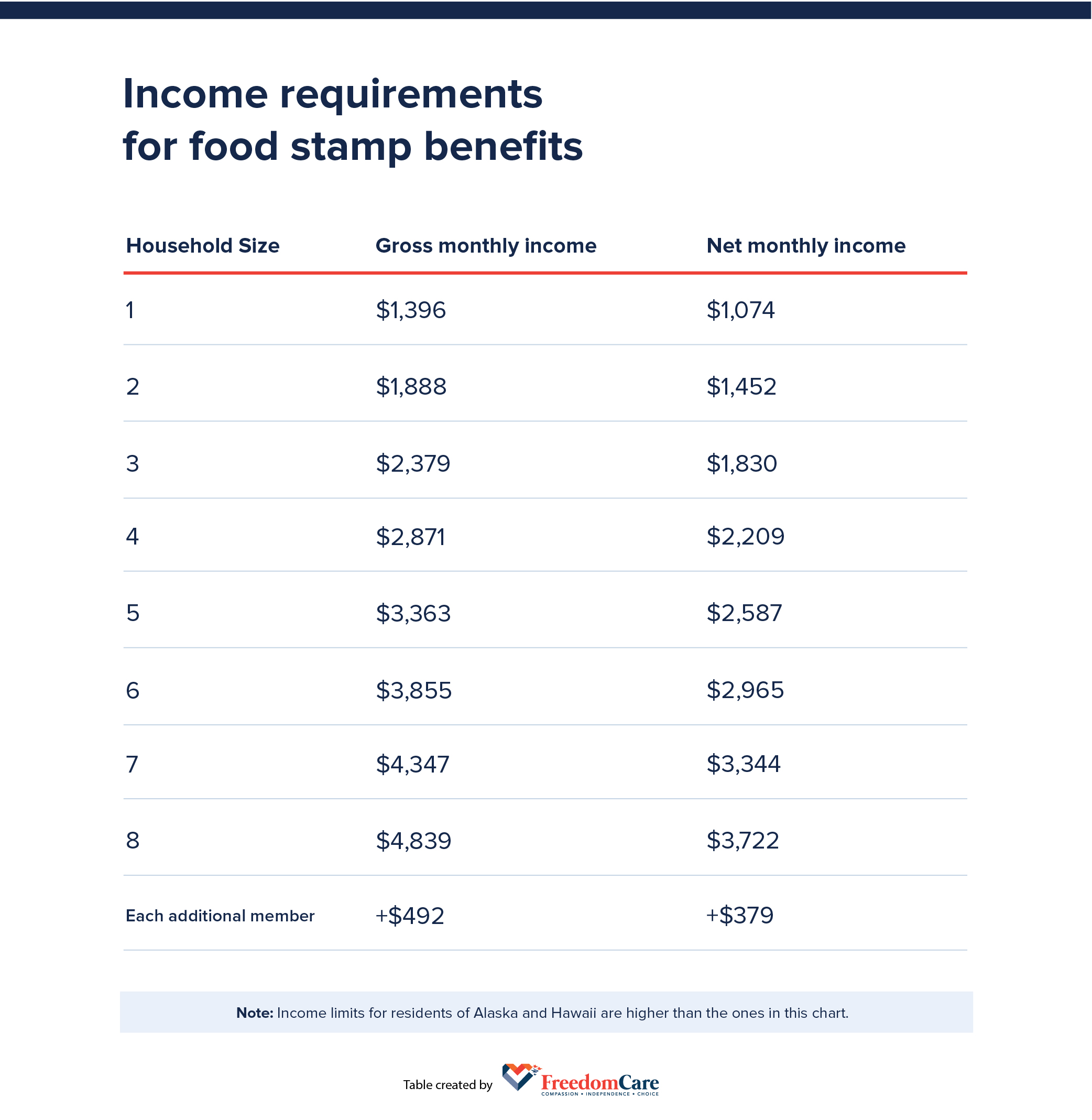

Chart For Earnings Food Stamps Ross County Deductions Certain deductions like the standard deduction and shelter cost deduction which can reduce your countable income are also updated The charts below list the before and after maximum benefits and monthly income limits for SNAP in Ohio

See the chart below for 2024 SNAP income limits Your net income is your gross income minus any allowable deductions For fiscal year 2024 Oct 1 2023 Sept 30 2024 a two member household with a net monthly income of 1 644 100 of poverty might qualify for SNAP Ross County South Central Ohio Job and Family Services 475 Western Ave Ste B P O Box 469 Chillicothe OH 45601 Phone 855 726 5237

Chart For Earnings Food Stamps Ross County

Chart For Earnings Food Stamps Ross County

https://i0.wp.com/foodstampsnow.com/wp-content/uploads/2018/12/food-stamps-income-chart.png?ssl=1

Income For Food Stamps 2024 Texas Minny Tamarah

https://assets-global.website-files.com/5a585cd951b49400018c874a/628ebc104b7c10a85467a94d_25457 - Food stamps blog post charts_FC - Income chart.jpg

[img_title-3]

[img-3]

Food Stamps for households with low income in Ross County Ohio Apply online or in person for SNAP with application form to check your eligibility Check your EBT balance and view the schedule in which the state of Ohio distributes their food benefits View when your benefits are made available The food stamp program is known as the Supplemental Nutrition Assistance Program SNAP and is administered by the USDA

Ross County JFS Office 475 Western Ave Chillicothe OH 45601 740 772 7540 This is a local County Assistance office will help with Cash Assistance child care child support food assistance SNAP health care Medicaid work support services and more In general however food stamps will look at your gross income and then deduct certain expenses such as rent and child care to arrive at your net income From there they ll compare your net income to the federal poverty level FPL to determine if

More picture related to Chart For Earnings Food Stamps Ross County

[img_title-4]

[img-4]

[img_title-5]

[img-5]

[img_title-6]

[img-6]

Your household must meet certain requirements to be eligible for SNAP and receive benefits If your State agency determines that you are eligible to receive SNAP benefits you will receive benefits back to the date you submitted your application You are now leaving the USDA Food and Nutrition Service website and entering a non government or non military external link or a third party site FNS provides links to other websites with additional information that may be useful or interesting and is consistent with the intended purpose of the content you are viewing on our website

CalFresh Program Monthly Allotment and Income Eligibility Standards Charts The chart below is effective 10 01 2024 to 09 30 2025 and provides the CF maximum monthly allotment This chart also provides monthly income limit amounts based on household size Learn about how much food stamp assistance one person can receive based on their income level and household size Find helpful information and insights into food stamp benefits

[img_title-7]

[img-7]

[img_title-8]

[img-8]

https://www.snapscreener.com › blog › annual-snap-update › ohio

Deductions Certain deductions like the standard deduction and shelter cost deduction which can reduce your countable income are also updated The charts below list the before and after maximum benefits and monthly income limits for SNAP in Ohio

https://www.ncoa.org › article › what-is-the-income-limit-for-snap

See the chart below for 2024 SNAP income limits Your net income is your gross income minus any allowable deductions For fiscal year 2024 Oct 1 2023 Sept 30 2024 a two member household with a net monthly income of 1 644 100 of poverty might qualify for SNAP

[img_title-9]

[img_title-7]

[img_title-10]

[img_title-11]

[img_title-12]

[img_title-13]

[img_title-13]

[img_title-14]

[img_title-15]

[img_title-16]

Chart For Earnings Food Stamps Ross County - The amount of CalFresh benefits a household gets depends on how many people are in the household and how much monthly net income remains after taking allowable deductions 7 C F R 273 10 d 273 10 e 1 273 10 e